How are you investing in your 2009 IRA?

A lot of people advocate maxing out your IRA in January to “get your money working for you right away.” I think they are just bragging that they have $5000 sitting in an account that they don’t readily need.

Just kidding.

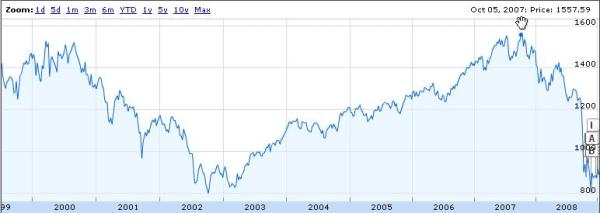

In a up market, dollar cost averaging works against you, and people do it out of convenience. It’s easiest to invest with each paycheck, and most people really don’t have $5000 sitting around. In a down market (hello 2008 ) it works for you. I’ve also heard that “in general” lump sum investing is better, but tell that to anyone who invested a lump sum in October 2007.

So, do you think 2009 will be an up market, or a down market? Beats me.

Last year I invested a lump sum in January ($1000) and dollar cost averaged the rest of the year. That was partly because I felt $1000 was all I could spare without depleting my cash, and partly because I wasn’t ready to throw dollar cost averaging out the window. And because I sort of like to make things more complicated than they need to be. Obviously, I would have been better off with straight dollar cost averaging, but I don’t have a crystal ball.

This year, I think I’m going to do the same thing. $1000 in January to give myself a head start, then $160 a paycheck for the remaining 25 paychecks. Of course, my 401k will be bi-weekly. What about you?

I’m starting a ROTH for the first time this year, I don’t have any money saved so I’m definitely not investing a lump sum at the beginning of the year. I haven’t figured out what I am doing either, my budget has $200 a month for the IRA. I don’t know if I’ll invest that each month (dollar cost average) or hold on to it for awhile and lump sum invest later when I figure out what I’m doing! I will say my lump sum investing hasn’t gone well, but really none of my investing has gone that well.

I’ve been torn about this. Its not like I have a ton of cash sitting around, but I’ve still been debating it in my head. Right now I’m putting in $100 weekly. The good news is that my shares have gone up a little bit in value in the past month, but then that gets me thinking that each $100 is going to buy me less and less.

My thoughts are I’m just going to keep contributing little by little. Its more convenient, and I don’t know whats in the future for me employment-wise right now. The money might serve me better in my emergency fund.

Final thoughts: I sure am glad I didn’t have the $5k when I opened my Roth IRA last year (October 2007, actually, lol)…I would’ve been feeling much more pain than I am now.

I haven’t decided yet. I lost so much money last year that I’m hesitant of maxxing out right away. I normally save during the year to pay for the upcoming year.

Right now the cash is just sitting in a 2.5% savings account while I make up my mind.

Ugh, I put in the full $5000 last January & February because I didn’t want to deal with logging into Fidelity every few weeks to make a deposit. Stupid.

This year I won’t be making any overtime, so averaging will be necessary.

Great article! And that’s a good question… last time I got COMPLETELY burned. I invested 5k in January of 2008. 😦 A lot of good that did me! I really have to believe that we’ve bottomed out and things HAVE to get better from here. If I have the money, I am dumping ALL of it in ASAP.

Now they’re saying the first of the year pop we saw was due to people funding these IRA’s. Me, I will get to them when I get to them. They are one of my lower priorities, I need to save my rupees up. Maybe by November.

I contemplated this awhile back myself…I’ve put my trust in dollar cost averaging because I’m too afraid to put all my money in there at once. So it’ll be the limit/12 dollars once a month each month. I do like your method of lump sum to start and then smaller amounts afterward, just to get the ball rolling. I guess my first year of Roth IRA contributions I did it the opposite: contribute a bit monthly, then realize I haven’t maxed it out at the end of the year, and add the rest in at the end of the year.

I just put the whole $5,000 in last week. I do that every January so it’s kind of a “thing” – I want to stay consistent.

It’s still dollar cost averaging; it’s just once a year instead of once a month or once a week. My 401k is done bi-monthly, my Roth IRA is done annually.

I put in all $10,000 (me and my wife) at once at the beginning of the year. This is mostly to minimize fees since the account I use charges me $4 per fund buy regardless of the amount I buy. I usually spread it out amongst six different funds and therefore pay only $32 in fees for each $10,000 investment (or 0.32%). (I buy the two largest in my wife’s account and four in my own, so together we’re balanced though separately we aren’t.) I also do “lazy rebalancing” to rebalance every year. As Meg says, it’s still dollar cost averaging. I don’t know if I’d do the same if the money I was contributing represented a more significant fraction of my net worth.

@Andrew – I don’t really care to argue over semantics, but I think maxing out an IRA in January of every year falls into the “lump sum” category rather than DCA. I can see where you are coming from categorizing it as DCA though.

Not that it really matters. We can call it whatever we want, the effect is the same. Your comment about the fraction of your net worth is really key, and I never thought of it, but it makes a huge difference. Right now $5k is roughly 1/5 of my total net worth, 1/5 of my total investments in the market, and 1/8 of my total assets. And 1/3 of my cash. That has a huge impact on my choice not to dump it all in at once.

In general, I don’t know how much of a fan of DCA I am. The markets go up roughly twice as often as they go down (I know it’s hard to remember that with the current market), so you’re basically giving up some amount of expected return in exchange for lowering your variance (risk). I’m not knocking that at all, but you are going to (on average) make less money through DCA than lump sum.

So the question, for me, always comes down to: do I care enough about lowering the risk in order to give up some of the gain? If you gave me a $5,000,000 lump sum right now, it’s a no-brainer. I’d dollar cost average it over a period of years. I assume that nobody, given a windfall of $50 that they wanted to invest, would dollar cost average it. So it’s all relative to one’s own financial situation and appetite for risk.

Agree that overall, “lump sum” is better, because in general, the market goes up over time.

The thought of using DCA to average $50 made me smile. 🙂